Our Thoughts on Recent Market Volatility

The Coronavirus has been the primary culprit for a recent market sell-off, with U.S. & global risk assets declining sharply this past week. The recent sell-off in global equity markets has firmly placed the broader stock market into an official correction. Another similar week will place global equity markets well into a bear market. The losses may still extend for weeks or months as the market doesn't like uncertainty - especially around all-time market highs with investors looking for reasons to exit and take profits. If losses do continue, you can count on many media outlets and financial publications to continue with alarmist headlines (these headlines will exist regardless). The truth is, Wall Street and global capital markets often look to consider and price reality before reality ever even actually occurs. In a broad context, this is done through a combination of historical data, projections using analyst estimates and assumptions, and consideration of present economic conditions - among other factors. Understanding these factors is crucial in projecting an asset's worth in a market economy. The Coronavirus though is an unknown factor, and markets don't like uncertainty it doesn't know how to account for - especially when markets have been high for some time. Of course, the virus' short-term impact on the global economy can be projected to an extent, and it is reasonable to assume - at a minimum - near-term economic strain and stress on our healthcare systems. However, the longer-term duration or impact of the virus' spread remains highly unclear and it would be premature to speculate. At this point in time no one knows for certain what it's true impact will be or how capital markets will respond moving forward, which is of course no different than usual.

What can you do? Understand the market environment, maintain perspective, practice discipline, and focus on what you can control. These principles are more important now than they've been in several years. Ideally, you've been planning along the way to be in a position to better navigate market turmoil by having a properly designed and/or managed portfolio for some time in tandem with a financial plan. Still though, long-term, real-life portfolio returns - the actual results you get - are most dominantly driven by an investor's own behavior. Having a plan along with a thoughtfully constructed and diversified portfolio that may - or may not - invest in traditional equities or bonds is crucial to properly navigate risk. If you don't follow that plan though when you need to most, it may all be for nothing. Without a plan, it's hard to know if you're taking too much or not enough risk at a time like this, thus making it harder to know what you can really control, where you should be focusing any efforts, and controlling investment behavior. Carl Richards states it best in his classic graphic, included below:

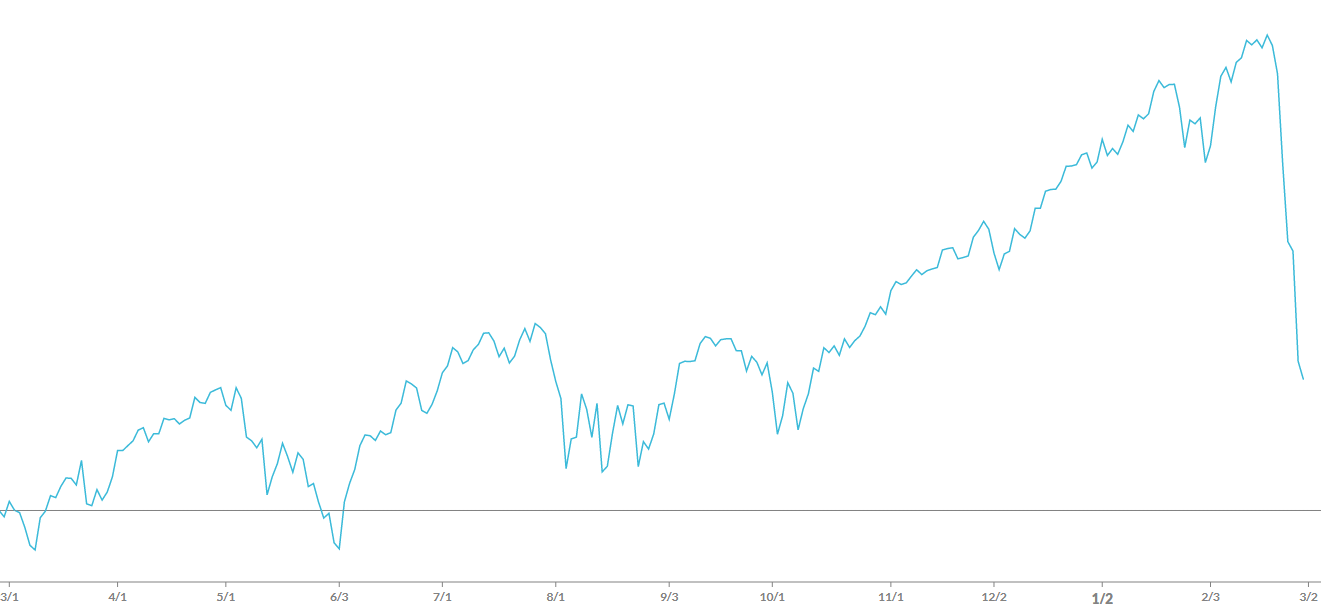

Consider the first chart below. A pretty steep drop at the end, right? That is almost entirely from the last week. In total, the chart shows the S&P 500's performance over the last year. Despite the steepest single-week decline of the index since 2008, and one of the steepest single-week declines ever, the index is still positive over the last 12 months (by approximately 6%).

Now consider the second chart (below). It shows the S&P 500's performance over the last 10 years. It has returned 168% on price alone - not necessarily considering investor total return. This is over 16% per year using a basic average of annual return over a 10-year period. This is AFTER a week which saw the sharpest single-week decline since 2008.

While this alone may not provide any specific comfort for your own portfolio today, these visuals can at a minimum serve as a helpful reminder to keep things in perspective. You can choose to focus on the days or you can choose to focus on the decades - assuming you have a properly allocated portfolio along the way. We would rarely, if ever, recommend that an investor purely invests in the S&P 500 only. If you had a properly diversified portfolio beyond only the S&P 500 though, your volatility would likely be even less and you'd have a portfolio better equipped to manage markets swings while also actively working towards your financial goals. If you cannot stomach the recent swings in the market - and it's likely continued upcoming volatility - it is a telltale sign that you perhaps should have never been invested that way to begin with. It is also perhaps a sign that a real financial plan is in order.

As always, where possible, remember to tune out the noise…

Disclosure: Hudson Oak Wealth Advisory LLC (“Hudson Oak” or “Hudson Oak Wealth”) is a registered investment adviser in the State of New Jersey & New York. For information pertaining to Hudson Oak’s registration status, its fees and services and/or a copy of our Form ADV disclosure statement, please contact Hudson Oak. A full description of the firm’s business operations and service offerings is contained in Part 2A of Form ADV. Please read this Part 2A carefully before you invest. This article contains content that is not suitable for everyone and is limited to the dissemination of general information pertaining to Hudson Oak’s Wealth Advisory & Management, Financial Planning and Investment services. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this presentation will come to pass. Investments involve risks and may lose value. Figures displayed within this communication are for illustrative purposes only. Nothing contained herein should be interpreted as legal, tax or accounting advice nor should it be construed as personalized Wealth Advisory & Management, Financial Planning, Tax, Investing, or other advice. For legal, tax and accounting-related matters, we recommend that you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized planning from Hudson Oak. The content is current only as of the date on which this article was written. The statements and opinions expressed are subject to change without notice based on changes in the law and other conditions.