“What should I do with my concentrated stock position?”

This is a question we field on a regular basis at Hudson Oak. Many of our clients first come to us with concentrated stock positions that they have obtained either through their employment, equity compensation, sale of a business, a well-timed trade, from family, or through some other means. They all share a common theme of idiosyncratic (non-systematic) risk which is inherent in owning a concentrated position. The specific risks however, and potential rewards, can be unique to each situation. They also all have unique wealth and tax considerations that need to be independently addressed. The facts of each unique situation, along with the stock owner’s financial goals and profile will guide the appropriate course of action in response to the common question of “what next?”. With U.S. markets having experienced a tremendous rise over the last 12 months (and even going back over the last decade), asking these questions and determining “what next?” is arguably going to be as important now as it has ever been for many in this position. This is especially true when the outcomes of such decisions can have a generational wealth impact. To best understand the facts and choose the appropriate course of action it is crucial to grasp the risks and rewards of concentrated stock ownership.

A concentrated stock position is often considered as a single stock position that makes up over 20% of your investment portfolio. To slightly differ we’d say concentration risk arises anytime a position becomes material enough that it could adversely impact a financial plan (which isn’t always at a 20% threshold). This can often occur at levels as low as 10% to 15% of an overall investment portfolio. A common theme across most concentrated stock situations is that there is an emotional attachment to the position. It is natural to associate the good fortune that someone has experienced with a single stock holding thus far with their own investment prowess (whether true or not) while simultaneously not fully appreciating the inherent and unique risks that come with managing a concentrated position. A key part of the overall process in understanding what to do next is to acknowledge and accept this potential bias and remove the emotional attachment so that smart decisions can be made.

To answer the hypothetical question our article title poses (“What should I do?”), it can be helpful to have a basic framework in place. We have broken out some of that framework below - from understanding the landscape, having historical context, understanding why concentration poses risks, being able to accurately and correctly analyze the figures, knowing your options, and fitting them all together as part of a specific wealth management and financial plan.

understand Your environment

U.S. capital markets & the U.S economy as a whole is a competitive landscape with constant disruption, new entrants, and opportunities for wealth creation. It is one of the benefits of a capital society that lends itself to encouraging entrepreneurship and risk-taking to meet consumer demands. As a result, our nation consistently ranks towards the top of all metrics measuring the number of wealthiest individuals and entrepreneurs. From the environment of opportunity arises many situations involving concentrated stock wealth. This can be rewarding for owners and shareholders but also creates a dynamic where the risk of business displacement, and therefore dramatic changes in their business’ stock price, is constant. Understanding that the investment landscape and environment in the U.S. is highly competitive is the first key aspect of appreciating the position that concentrated stock wealth can have in someone’s financial plan.

Next, it is important to consider the concentration risk in a more historical context to help provide a frame of reference. JP Morgan Asset Management recently updated their research on this very topic in their report from March 2021 titled “The Agony & The Ecstasy”. Their research will help guide many of the data points of our discussion from here on out.

2. understand your history

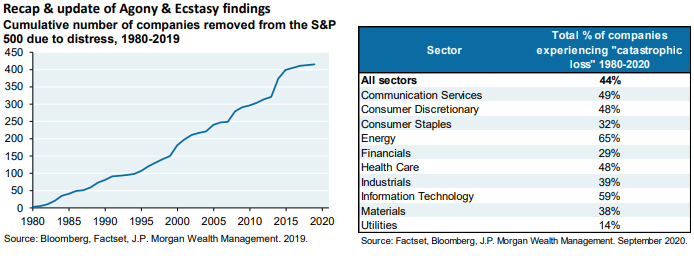

According to JP Morgan’s research, over the last roughly 40 years from 1980 through 2019 over 400 companies have been removed from the S&P 500 due to “business distress”. This translates to 44% of all constituents of the index being removed over this time, with roughly 60% of those in the information technology and energy sectors being removed. These figures from JP Morgan’s report can be seen below.

Source: J.P. Morgan “Eye on the Market”, March 2021.

Taking a broader view of the U.S. stock market, the Russell 3000 has seen roughly 40% of the companies to have ever been included in its index experience a “catastrophic stock price loss” which JP Morgan defines as a 70% decrease in stock price from its peak level and no subsequent recovery. Our assumption would be that the 40% figure would only increase (possibly to 50%) if the metric to measure a “catastrophic” loss was lowered to a 50% decrease without recovering - a still significant figure. If there was at least a 50% chance that your concentrated stock position would experience a 50% loss with no recovery back to previous highs, would you handle your position differently?

Now that the U.S. business landscape and U.S. single stock risk has been established we can consider what alternatives exist in a historical context. Once again, JP Morgan’s research has helped establish that over the last 40 years from (1980 through 2020):

42% of companies in the Russell 3000 would have underperformed a cash-only position.

66% would not have fared better than the benchmark itself.

10% would have significantly outperformed the benchmark.

The median outcome from the dataset was that a single stock’s annualized return underperformed the benchmark’s annualized return by greater than 10%. Below is the distribution of returns from JP Morgan that shows this median outcome over the last 40 years.

Source: J.P. Morgan “Eye on the Market”, March 2021.

3. understand the “why?”

If the numbers suggest that most companies do not perform better than the broader market over time that is one thing, but why exactly DO they fail? Why don’t investors see it coming sooner if the odds are generally stacked against them in a concentrated position? The reasons for business failure or poor investment results is that it is often outside of the company’s own control. Regulations, geo-political trends, new market entrants, price changes, and more factors that can’t be hedged away or controlled by a company are inherent risks to many businesses. In hindsight it is easy for investors to claim the reasons a business failed were obvious, however in the moment this is rarely the case. The reasonable conclusion to draw here is that most of the time an investor (and even the company itself!) won’t see the biggest risks and changes coming far enough in advance to do anything about them, just that they DO indeed happen. Some companies are better at navigating those challenges than others and most of it is well out of any individual’s control. As such, investors would be well suited to focus on what they CAN control - how they choose to manage this exposure in a thoughtful way. The numbers clearly show that owning concentrated stock positions is risky. The difficulty is knowing what options exist to properly manage all of this potential risk to be able to make wise decisions, at the right times.

4. understand the analysis needed

To be able to understand the ultimate options available, one needs to be able to assess what analysis should occur. Decisions will have to be made among several possible options, but in order to assess the options accurately proper analysis must occur. The analysis should start with having a real financial plan that prioritizes competing goals across varying time horizons and displays the resources needed to achieve these goals. As part of this plan, an evaluation of overall risk tolerance and how an investment portfolio may help meet these goals should occur and should consider how concentrated stock should be accounted for. Tax planning and analysis will be a crucial consideration as well as part of the overall analysis of how to best approach managing a concentrated stock position. What something is worth before tax is one consideration, what something is worth after taxes (depending on a variety of different decisions and outcomes) is entirely different. Further, if the concentrated stock position is so material to an individual’s wealth it is often wise to consider estate planning needs as well.

Working with a team of professionals can benefit an individual investor with concentrated stock wealth as affords them the ability to see the entire picture and have advocates in their corner to help guide the decision-making process. Having a team in place that understands the financial, investment, taxation, and estate considerations can help drive this process in a way that may yield more overall value and peace-of-mind. As human beings we simply don’t know, what we don’t know, and having a competent team in place can ensure that fatal flaws are less likely to occur with respect to what may otherwise be a once in a lifetime opportunity.

5. understand your options

Once you understand the areas of analysis that most commonly need to be consider to manage a concentrated stock position, assessing the common options for action is the next step. Managing a concentrated stock position can take several forms, but the options tend to have a common theme of managing the overall exposure while de-risking in a cost and tax efficient manner that satisfies financial goals while providing security. JP Morgan’s research succinctly put it, the core options available to a concentrated stock owner are - sell, monetize, diversify, give and hedge. Our take is that there is some natural intersection between these concepts and therefore we have combined sell, monetize and diversify into two overlapping alternatives below due to their varying tax impacts.

Selling & Diversifying with Immediate Tax Impact

Selling is often the most practical and easiest way to divest from a concentrated position. The simplest approach is to sell a position, realize a likely gain, pay your taxes and move on. Sometimes this simple approach is entirely appropriate, however most investors rarely exit an entire position in one moment. The most common approach is having a sales plan over a period of time - which we often do with clients. Laddering sales over a period of time to manage the price risk and tax consequences is often a reasonable approach from an analytical perspective while also considering the behavioral side of these transactions (i.e. fear of missing out, trading out too soon, etc..). Beware however, that if a concentrated stock position is held by a company insider and they possess enough inside knowledge or are an executive they may often be best served to implement a 10b5-1 plan.

Another common strategy is to use call options to hopefully achieve a slight premium for exiting a concentrated position. By using call options at a price that is above the current fair market value of the underlying concentrated position, an owner may be forced to sell/deliver securities to the option holder if certain price points are hit. This does accomplish two things which may be desirable to a holder. First, they are being compensated on the premium for the call options at a minimum. Second, they should use the call option at an exit price they are comfortable with, thus meaning if that price occurs and they have to sell some of their position they are satisfied with the result at that price point. It also takes some of the decision-making out of the investor’s own hand and allows them to stick with a plan. What this strategy does NOT do however is protect on downside risk.

Whatever the method of outright sale, it tends to lead to tax considerations that can often deter a concentrated stock holder from looking to sell. Despite the tax impact, due to the volatility of many single stock positions, incurring some taxes to be able to then redeploy the residual capital is often the right decision to protect against catastrophic loss. The tax cost of diversifying properly (as appropriate for a financial plan) is often LESS costly than the risk of being wrong about a concentrated position that then goes against the owner. If done properly, the disposition of a concentrated stock position can then lead to a more focused tax-managed portfolio strategy that is able to take advantage of the dispersion we have so clearly pointed out exists across indexes (see Russell 3000 data above) by implementing tax-loss harvesting strategies. Concentrated positions may have been responsible in helping to create significant wealth in someone’s life, however they can also then become the most likely source of dramatic losses which then naturally puts a financial plan at risk. There is a saying that concentrated wealth may help you become wealthy, but diversification is more likely to keep you wealthy.

Whether divesting stock is the right decision or not will depend on other factors in someone’s overall financial plan and profile. For those that are most tax sensitive or cannot exit a position through an outright selling approach, monetization may be an appropriate option.

Monetize or Diversifying with Deferred Tax Impact

Monetizing and Diversifying are two separate concepts but can be viewed in tandem as part of a more deferred means of enjoying some of the concentrated stock benefit today without removing exposure or paying taxes. Monetizing a position often can allow a stock holder to benefit from the wealth of the concentrated position without either a) selling the exposure outright or b) having the position be significantly eroded due to taxes from a sale. Diversifying in this context yields similar risk management as in option 1 above, yet may reduce the same level of immediate tax impact a seller would otherwise face. At the same time, this method of diversification often comes with a loss of some control, so there are definite trade-offs.

A common monetization approach is using securities-based credit, though it often does not reduce the overall risk. Securities-based credit allows a concentrated stock holder to pledge securities with a lender in order to access capital via a line of credit, thus providing liquidity without incurring the tax costs of a sale. Prudent minds would likely advise that this should only be done with a portion of a concentrated position to satisfy short-term liquidity needs. The risk with securities-based credit is that if the stock price goes against the owner it could lead to collateral issues with the lender. This makes this approach more likely to be a short-term, limited-use option rather than a long-term, risk management solution for the risks posed by concentrated stock positions. Adding options strategies to hedge (collar) concentration risk can be done in tandem with securities lending strategies to reduce some risk but comes at an ongoing cost of the options and still likely does not solve the longer-term risk or financial planning issues at play.

Two monetization strategies that arguably fall more into the “diversify” bucket are a Charitable Remainder Trust (CRT) or an Exchange Fund. A CRT (as we’ve written about before) is sometimes an appropriate approach as it will allow for divesting out of the risk inherent with a concentrated position while still receiving a benefit at a much reduced initial tax cost for a period of years. A CRT allows for unique tax planning and concentration management in exchange for the economic benefit of the portion of the stock transferred to a CRT being stretched out over time, rather than enjoyed immediately upon a sale. An Exchange Fund may allow certain concentrated stock holders to contribute shares of their stock in-kind to a fund in return for fund units. The fund will receive shares from other owners as well which ultimately can create a diversified investment pool. After a period of years, the investor can redeem their units for a basket of other securities. The result is that they have experienced a more diversified investment result, but they still retain a similar tax situation upon sale that they would have originally had. Again, the trade-off in both a CRT and an Exchange Fund is the lack of control and access in exchange for a more diversified approach and limited or deferred tax impact which isn’t available in an outright sale. CRTs and Exchange Funds have many other features and considerations that should be understood before ever engaging, and should likely only be implemented with a team of trust financial, tax, and legal advisors in place.

Give

For those with charitable or philanthropic desires, giving concentrated wealth can be a useful tool as part of an overall wealth management strategy. Giving is powerful in multiple ways as it allows potentially for: a) meeting family or charitable goals, b) can minimize overall concentration risk of family wealth and bring the total wealth portfolio into better alignment, c) avoid or minimize income taxes, and d) possibly remove or reduce wealth transfer taxes. If executed wisely, giving can accomplish many goals at once.

The first and most simple way of using giving to manage concentrated stock wealth is by simply gifting shares to family. If done properly, giving to family will allow for the ultimate sale of stock to incur a lower rate of tax (than if the original owner had sold in a higher bracket) and possibly reduce the size of the donor’s estate. Most donor’s that are in a position to be gifting away wealth should be at least aware of the wealth transfer tax considerations. Beyond their annual exclusion amounts, gifts may be subject to gift tax. As such, gifting in ways that discount the present value of the donor’s gift can reduce (or potentially avoid gift taxes). Strategies like Grantor Retained Annuity Trusts (GRATs) can help move concentrated stock wealth out of an estate at minimal transfer tax cost. While this approach will not immediately reduce the concentration risk, it may ultimately allow funds to be removed from an estate and possibly sold by trust beneficiaries at more favorable tax rates.

The other most common way of giving concentrated stock is to share this wealth with charity. If done properly, giving concentrated stock to charity can allow for an income tax deduction while the donor avoids ever having to incur income taxes on the unrealized gains of their position. The most simple way is to directly transfer stock to a charity. The next most common way is through the use of a Donor Advised Fund (DAF). A DAF can be more appealing because a transfer of stock can be made to the DAF in one year to obtain an income tax deduction, while the ultimate distributions out to charity can then happen over many subsequent years. Beyond this, a CRT (as referenced above) is sometimes an option to benefit charity many years into the future. A Charitable Lead Trust (CLT) is also an option for wealthy families. It is unique and powerful strategy that in it’s most simple terms is the opposite of a CRT. It can combine benefiting a charity today, obtaining an income tax deduction, and preserving wealth in the family at the end of the trust. A CLT and a CRT have very different tax and estate planning considerations however.

Hedge

The last of the most common alternatives is to simply hedge the position. If done effectively, this can limit the overall risk of the concentrated position while avoiding the need to sell or divest. To hedge, most owners would use a strategy of put and call options to “collar” their position. This protects the owner to an extent but may limit their upside. This can permit the owner of the concentrated stock position to maintain their exposure and potentially retaining the desirable benefits of their ownership position. As no sale is occurring there is no notable taxable events when compared to an outright sale. What this will not do however is allow for the economic enjoyment of their entire position. If the owner of the stock wants to ever realize the full value of the position, a sale will ultimately have to occur.

A hedging strategy makes most sense when the position must be maintained for a period of time. If a concentrated position has significant dividend income or potential, one could argue that maintaining the position could be worth the hedging strategy as opposed to incurring the taxes from sales. At the same time, hedging strategies tend to involve ongoing costs of maintaining the collar, which can potentially become costly depending on the duration and specifics of the concentrated position.

6. understand your plan

Having a broader plan is possibly the most crucial component, and while it is the last item listed here for reminder purposes, it is undeniably present in every step along the way. A financial plan that is founded in technical understanding, but considerate of personal preferences can help remove emotional decision-making and improve the odds of securing the financial opportunities that are desired. Even if a plan is in place however, it must be understood that sometimes things don’t go according to plan, yet having ANY real plan in place to start can keep you centered and have a baseline to refer back to. If nothing else, the last 12 months have been a clear reminder that the world we live in can change quickly and impact us in ways that are beyond our control. Not having complete control is inherent in a financial plan, but by having a financial plan you can have a strategy to refer to which can remove emotion and prevent poor decision making that may otherwise be irreversible.

closing

The answer to the question posed in the title of this article can’t be found for everyone in one fell swoop. What this article has aimed to do is inform concentrated stock owners of the unique opportunities and risks that they may face, and the areas they should be aware of. Beyond that, it is a matter of applying quality advice, judgement, and execution to ensure a financial plan is implemented and managed appropriately and efficiently to secure what is important to you, to underwrite a meaningful life however you define it (or however we may help you define that).

At Hudson Oak, our most abundant client focus is on families and individuals that have concentrated stock wealth - often, but not always obtained either through company equity compensation programs or family wealth. We help families make tough decisions surrounding concentrated stock wealth in a thoughtful way. For high-net-worth holders of concentrated portfolios we help manage overall wealth management plans across financial planning, investments, and taxes in one central advisor. If you are in need of a strategic partner to offer both strategy and independent advice for you and your family in this space, or simply to learn more about our offerings and approach, please feel free to contact us.

Much of the research figures used in this article can be attributed and credited to JP Morgan’s “Eye on the Market” Report dated March 15, 2021 and available in full here.

Disclosure: (“Hudson Oak”) is a registered investment adviser in the States of New Jersey, New York, and other states where exempt from registration. For information pertaining to Hudson Oak’s registration status, its fees and services and/or a copy of our Form ADV disclosure statement, please contact Hudson Oak. A full description of the firm’s business operations and service offerings is contained in our Disclosure Brochure which appears as Part 2A of Form ADV. Please read the Disclosure Brochure carefully before you invest. This article contains content that is not suitable for everyone and is limited to the dissemination of general information pertaining to Hudson Oak’s Wealth Advisory & Management, Financial Planning and Investment services. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this presentation will come to pass. Nothing contained herein should be interpreted as legal, tax or accounting advice nor should it be construed as personalized Wealth Advisory & Management, Financial Planning, Tax, Investing, or other advice. For legal, tax and accounting-related matters, we recommend that you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized planning from Hudson Oak. The content is current only as of the date on which this article was written. The statements and opinions expressed are subject to change without notice based on changes in the law and other conditions.